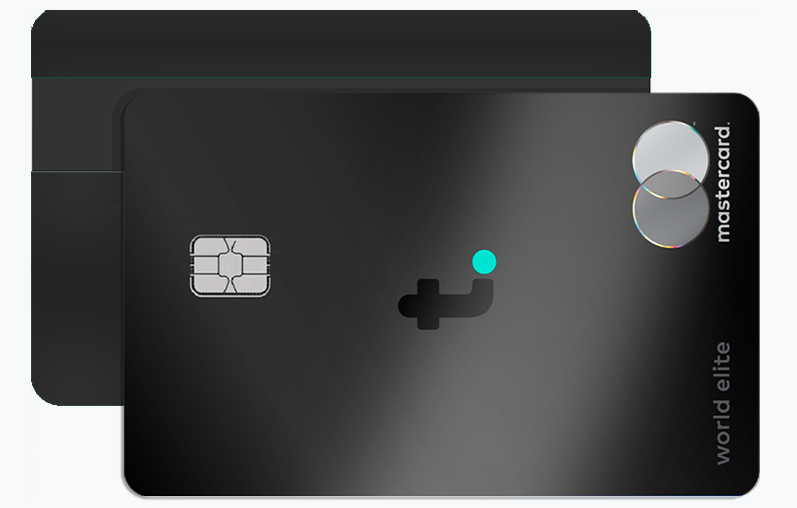

TOMO

$0 FEES | 0% APR NO CREDIT HISTORY REQUIREDIn today’s fast-paced financial world, having access to a reliable credit card without the hassle of credit checks or exorbitant fees is a rare gem. The Tomo Credit Card has emerged as an innovative financial product designed to serve those who want to build or rebuild their credit while enjoying straightforward benefits. This review dives deep into what makes Tomo unique, its top advantages, some downsides, and how you can apply to start your financial journey right away.

Top 3 Advantages of the Tomo Credit Card

1. No Credit Check Required

One of Tomo’s standout features is its no credit check policy. Unlike traditional credit cards that demand rigorous credit evaluations, Tomo opens doors for applicants regardless of their credit score. This makes it an excellent option for people with no credit history or those recovering from past credit mistakes.

2. Zero Fees and No Interest Charges

Tomo offers a refreshing approach with no annual fees, no late fees, and zero interest charges. Users can enjoy the flexibility of borrowing without worrying about hidden costs that often accompany other credit cards. This makes budgeting simpler and stress-free.

3. Instant Card Approval and Fast Digital Access

Time is money, and Tomo understands that. With a swift online application process, users receive instant approval and immediate access to a virtual card. This feature is perfect for digital-savvy consumers eager to start spending or managing expenses without waiting days for physical cards to arrive.

Two Disadvantages to Consider Before Applying

1. Limited Physical Card Availability

Currently, Tomo focuses heavily on virtual cards, which means that if you prefer using a physical card for in-store purchases, this might be a drawback. While this is ideal for online shopping, some users might find the lack of widespread physical card support inconvenient.

2. Spending Limits May Be Lower Than Traditional Cards

Because Tomo targets those building or rebuilding credit, the initial credit limits might be lower compared to conventional credit cards. While this encourages responsible spending, users looking for high-limit credit options may need to explore other products.

Keep Reading to Discover More About Tomo and How to Apply Today

Want to learn about the hidden perks of the Tomo Credit Card and how it compares to other no-credit-check options on the market? From exclusive cashback programs to financial education tools, Tomo provides unique features not easily found elsewhere.

Ready to take control of your financial future? Discover step-by-step how to apply for your Tomo Credit Card and start benefiting from an innovative, fee-free, and credit-friendly financial tool.