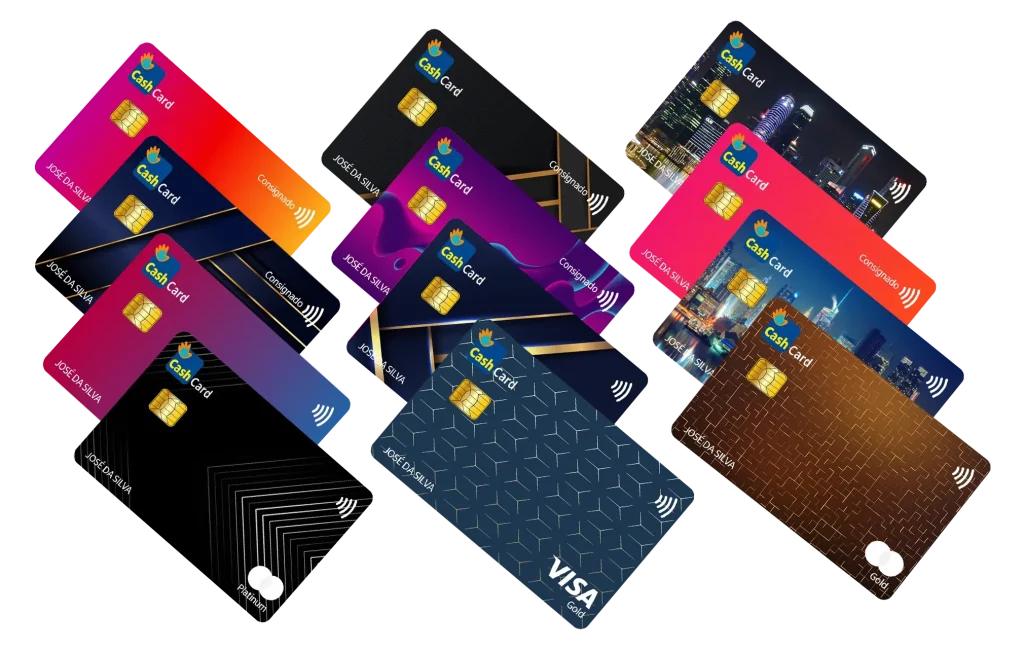

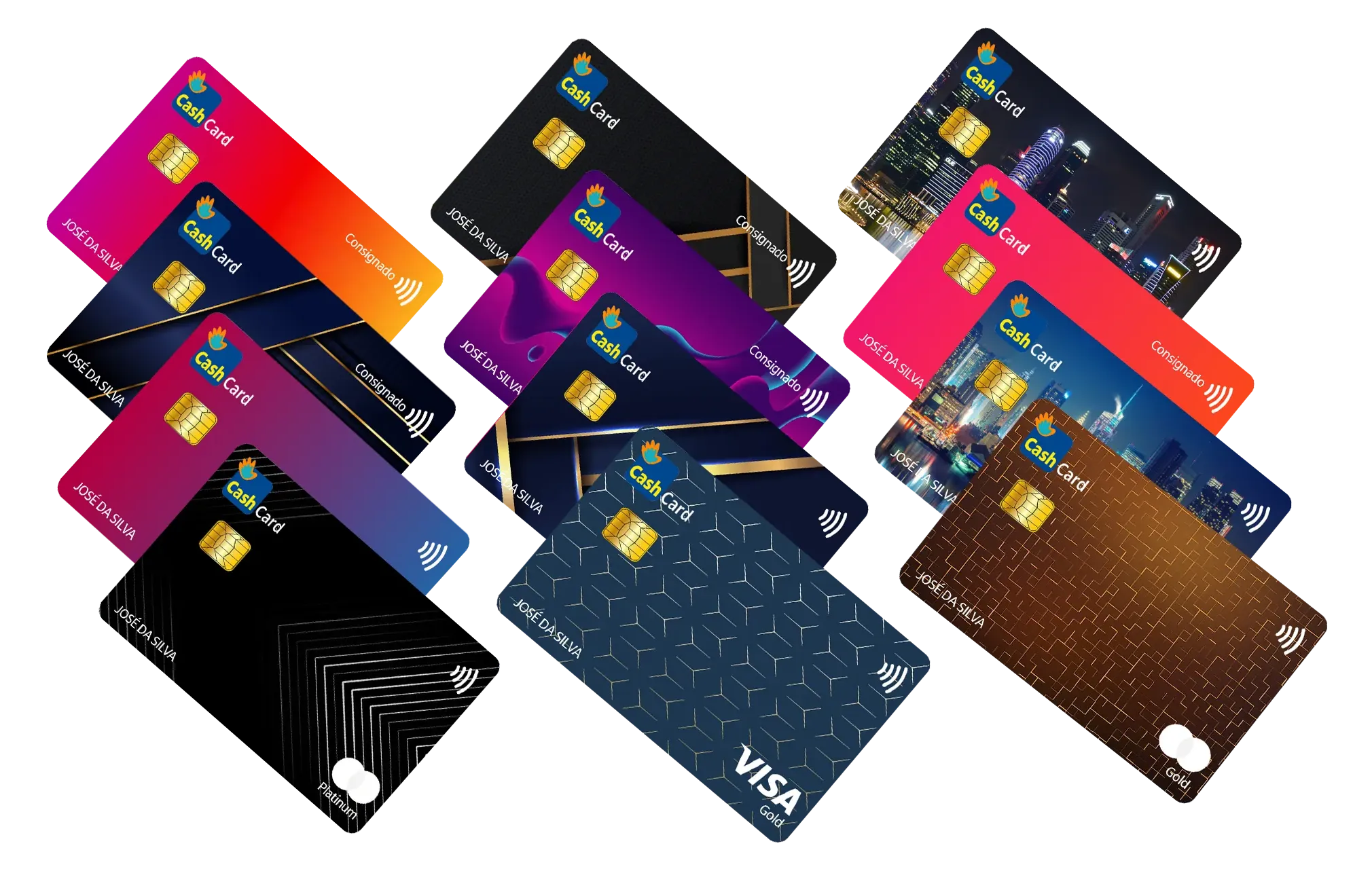

The Bank Cash credit card has been designed for those who seek not just a payment method, but also a tool that helps improve their financial health. With benefits that go beyond daily purchases, this card offers a way to manage your expenses while rewarding you at the same time. If you’re interested in learning more about how this card can transform your financial experience, keep reading. Here, we will explore the unique benefits, answer common questions, analyze eligibility, and provide you with a step-by-step guide to enroll in this financial product.

Benefits of the Bank Cash Credit Card

Access to Exclusive Promotions

One of the most attractive features of the Bank Cash card is access to special promotions at various stores and online platforms. This means you can enjoy significant discounts on your favorite brands, allowing you to save money on your regular purchases. Additionally, these promotions are often limited, adding a sense of urgency and excitement to your shopping.

Building Credit History

The Bank Cash card not only allows you to make purchases but also contributes to building a solid credit history. Every time you use the card and pay on time, you will be improving your credit score. This is essential if you plan to apply for loans or mortgages in the future, as a good credit history will open doors to better rates and terms.

Purchase Protection

Another significant advantage is the purchase protection offered by the Bank Cash card. If you make a purchase and the product turns out to be defective or doesn’t arrive, you can benefit from purchase protection. This means you will have an additional safety net that allows you to resolve problems without complications. This advantage is especially valuable in a world where online shopping is becoming increasingly common.

Financial Management Tools

The Bank Cash card also comes equipped with financial management tools that will help you keep a more precise track of your expenses. Through a mobile app or online platform, you can categorize your spending, set budgets, and receive alerts about your transactions. This will enable you to make more informed decisions and avoid surprises at the end of the month.

Personalized Financial Advice

Cardholders of the Bank Cash card have access to personalized financial advice. This includes consultations with experts who can offer you guidance on how to better manage your money, save for the future, and plan for major purchases. This advice is invaluable for those looking to improve their financial situation and achieve their economic goals.

Frequently Asked Questions about the Bank Cash Credit Card

What are the requirements to apply for the card?

To apply for the Bank Cash card, you generally need to be of legal age, have verifiable income, and possess an acceptable credit history. These requirements ensure that the card is granted to those who have the ability to manage credit responsibly.

How are payments managed?

Payments can be managed through the mobile app or online portal. There, you can view your balance, make payments, and schedule automatic payments to avoid delays. This simplifies the control of your finances.

What should I do if I lose my card?

If you lose your card, it is essential to notify Bank Cash customer service immediately. They will help you block the lost card and issue a new one to protect your account.

Are there late payment fees?

Yes, there may be late payment fees if you do not meet the due date. It is advisable to set reminders or use automatic payments to avoid these charges.

Can I use the card abroad?

The Bank Cash card is accepted in many countries, but it is advisable to check the fees for overseas use. This will help you avoid surprises on your statements.

Eligibility for the Bank Cash Credit Card

To apply for the Bank Cash credit card, you must meet the following requirements:

- Be of legal age

- Reside in the country where the card is issued

- Have verifiable income on a regular basis

- Provide official identification

- Have an acceptable credit history

- Have a valid phone number and email address

- Demonstrate the ability to pay

- Provide proof of address

- Not have any outstanding debts

Steps to Enroll in the Bank Cash Credit Card

Step 1: Gather the Necessary Documentation

Make sure to have all required documents, such as your official identification, proof of income, and proof of address. This will facilitate the application process.

Step 2: Access the Official Website

Visit the Bank Cash website to begin the application process. Ensure that you are on the official site to avoid fraud.

Step 3: Complete the Application Form

Fill out the application form with your personal and financial details clearly and accurately. This will help expedite your evaluation.

Step 4: Submit Your Application

Once you have completed the form, submit it for review by the Bank Cash team. Keep a record of your application for future reference.

Step 5: Wait for Approval

After submitting your application, you will need to wait for the approval notification. This may take several days, so be patient.

Step 6: Activate Your Card

If your application is approved, you will receive the card by mail. Follow the instructions to activate it and start enjoying all its benefits.

Conclusion

The Bank Cash credit card is an excellent option for those seeking not just a payment method but also a tool to help improve their financial health. With benefits like exclusive promotions, purchase protection, and personalized financial advice, this card can be your ally in managing your expenses. Don’t miss the opportunity to optimize your financial experience and acquire the Bank Cash card today. Transform your shopping habits and achieve your economic goals with this fantastic tool!

Citi Rewards Card: Elevate Your Spending with Unmatched Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Discover the Ultimate Rewards Experience with the Citi Rewards Card</p>

Citi Rewards Card: Elevate Your Spending with Unmatched Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Discover the Ultimate Rewards Experience with the Citi Rewards Card</p>  Wells Fargo Active Cash Credit Card: Your Gateway to Effortless Cash Back <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Unlock Endless Rewards with the Wells Fargo Active Cash Card</p>

Wells Fargo Active Cash Credit Card: Your Gateway to Effortless Cash Back <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Unlock Endless Rewards with the Wells Fargo Active Cash Card</p>  Capital One Platinum Credit Card: Your Key to Building a Stronger Financial Future <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Experience Financial Freedom with the Capital One Platinum Card</p>

Capital One Platinum Credit Card: Your Key to Building a Stronger Financial Future <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Experience Financial Freedom with the Capital One Platinum Card</p>